2021. What an interesting year. With the world turned upside down by a pandemic that seemingly had its sights set on...

HPE announces Q3 2020 results; Neri named #1 Influential Exec of 2020

HPE - NonStop Insider

For anyone who spends time looking through HPE press releases and reading analysis from industry and financial folks, it’s always a good month when you see nothing but positive news about HPE coming from almost all involved. HPE’s stock price took a tumble this year along with many tech stocks; COVID-19 impacted everything from supply chains to how best to manage staff. And HPE didn’t escape the full impact of COVID-19 in any way, but even so, the company regrouped, changed some practices and seems to have weathered the storm far better than the industry and financial folks had expected.

Predictions are always subject to dissection with hindsight. However, what was not debated was the overall leadership of HPE as demonstrated by its CEO, Antonio Neri. Indeed, it was only July 27, 2020 when CRN came out with its list of 25 most influential executives of 2020 where Antonio Neri found himself in first place, and where CRN in awarding first place to Neri, said:

“ … it was more than the financial commitment that set Neri apart: It was his personal commitment to partners, customers and employees.

“Just as importantly, Neri provided a compelling vison for the future for partners, doubling down on his big bold bet to deliver the full HPE portfolio in an as-a-service model by 2022.

“That new era, Neri said, will be defined by insight …”

Perhaps more importantly for the NonStop community however, was the news that broke of HPE’s Q3 2020 financial results that saw an immediate jump of 8% in the company’s share price. Knowing Neri has the best leadership skills when it comes to being influential, it’s probably even better to know that he is driving a more balanced, predictable and indeed increasingly profitable HPE.

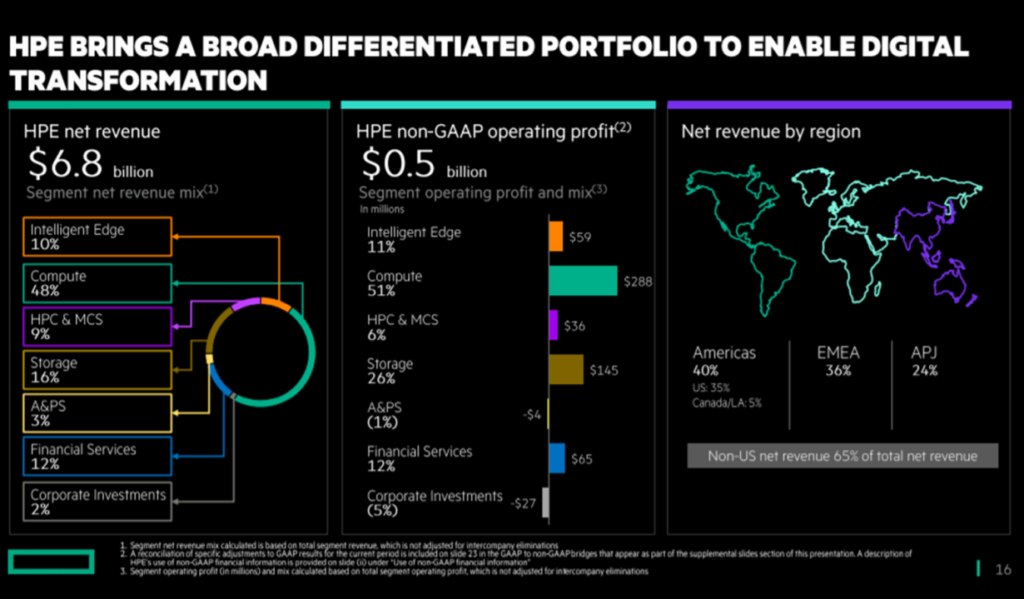

As for the highlights contained within the HPE Q3 financial results (summary slide, above), the following are worth taking note – coming from the analyst call that followed release of the Q3 results:

Antonio Neri –

We gained momentum in key areas of differentiation, driven by customer demand aligned to our strategy, and we began to take decisive and prudent actions to strengthen our core financial foundation, while we continue to align resources to critical areas of growth.

Moving forward, we expect continued gradual performance improvement. We made significant improvements in our supply chain execution, reducing our backlog by more than $500 million from our Q2 historical high exit levels, which contributed to our results.

Our pivot to as-a-service continued its strong momentum in the quarter. Our annualized revenue run rate of $528 million grew 11% year over year. GreenLake services orders grew a record 82% year over year. We believe this is faster than the orders growth of public cloud vendors and it is a validation of our hyper strategy and competitive differentiation.

Underpinning our customers’ cloud experience is the need for software. That is why we introduce our new HPE Ezmeral software portfolio. Our new portfolio includes a container platform that deploys Kubernetes at scale for a wide range of use cases on bare metal and virtual machines. A data fabric that delivers enterprisewide global access to data from edge to cloud with best-in-class reliability, security and performance, and machine learning operations solution that increases speed and agility for machine learning ops by operationalizing end-to-end processes from pilot to production, as well as IT operations and automation to improve productivity and mitigate risk of service disruption.

Big Data storage, which is built on unique intellectual property from our MapR acquisition to enable real-time analytics for mission critical Big Data overloads, grew revenues 31% year over year.

HPE stock has gradually returned to its beginning to be viewed once again as a value stock. If you want to invest in growth stocks then HPE may not meet your metrics but that’s quite OK as far as the NonStop community is concerned. Being able to purchase NonStop systems that will continue to be supported for years to come is the most valuable asset HPE possesses today.

It is no coincidence then that for HPE and for the HPC & MCS group, NonStop continues to provide not just the best margins but contributes to top line growth as well. In other words, there is plenty of funding for even more development of NonStop to better meet the goals of enterprises seeking solutions supporting their mission critical applications. And, from the Q&A that followed the update by Neri, two questions and their responses proved enlightening:

Q (Shannon Cross – Cross Research Analyst): Antonio, can you talk a bit about what customers are telling you, maybe on a geographic basis or looking at your segments, about what they’re looking to invest in, how they’re feeling about IT budgets?

A (Antonio Neri): First of all, they’re looking to strengthen their operations, and therefore, IT plays a huge role with that, and IT resiliency is more important than ever. So, anything that comes with security and enables them to digitize their processes is on the growth side. Second is, obviously, they have a lot of data and they need to get insight from that data and we see an acceleration of solutions related to AI and machine learning, and that’s why our big data storage saw another great solid performance … And then, anything that preserves capex is also in high demand. And that’s why we see significant momentum with our HP GreenLake cloud services, because that’s a true conceived as-a-service offering.

Q (Katy Huberty – Morgan Stanley Analyst): Can you put context around the 500 million of backlog worked down this quarter … Maybe talk through the factors that will get you back to the 30% to 40% growth target?

A (Antonio Neri): Yeah. Actually, I will say a couple of things to that comment on the backlog, Katy, I mean this is product shipped, right? Not all that product was totally recognizable in the quarter, particularly in HPC. Because if you remember, right, in the HPC segment, we got to ship it, we have to install it, we have to turn it on, and we have to run the test. And only when the customer signs up for the acceptance, then we can recognize revenue … And their value proposition is resonating more and more because the world is hybrid, cloud is an experience, and obviously, our software capabilities, they are playing a huge role together with our innovation on the business model side, and obviously, the financing. So that’s what we see. And the Annualized Revenue Run-Rate (ARR) will take care of itself because, obviously, there is puts and takes because remember, ARR is a consumption-driven metric of it and as we go forward, we are very, very confident to confident to hit that 30 to 40%.

Perhaps best of all was the summary that Neri gave to CRN:

“The reason we are doing well is we provide a true hybrid experience. Cloud is not a destination. It is an experience. Seventy percent of the apps and data are still on prem, and more and more apps and data is moving to the edge. Customers want a true consumption driven model from edge to cloud. GreenLake offers that in an automated way.”

This is important information for us all as decisions made by the NonStop community represent long term investments in products. The sector where NonStop excels is in support of mission critical applications. These are the interfaces an enterprise has with its customers and partners and where an enterprise is judged on its business abilities minute by minute. If you have plans to purchase a new NonStop system, isn’t it important to know that your vendor – in this case HPE – is going well and that its leader is recognized as the most influential executive of 2020?