2021. What an interesting year. With the world turned upside down by a pandemic that seemingly had its sights set on...

HPE NonStop Corner – one partner’s perspective

NonStop Insider

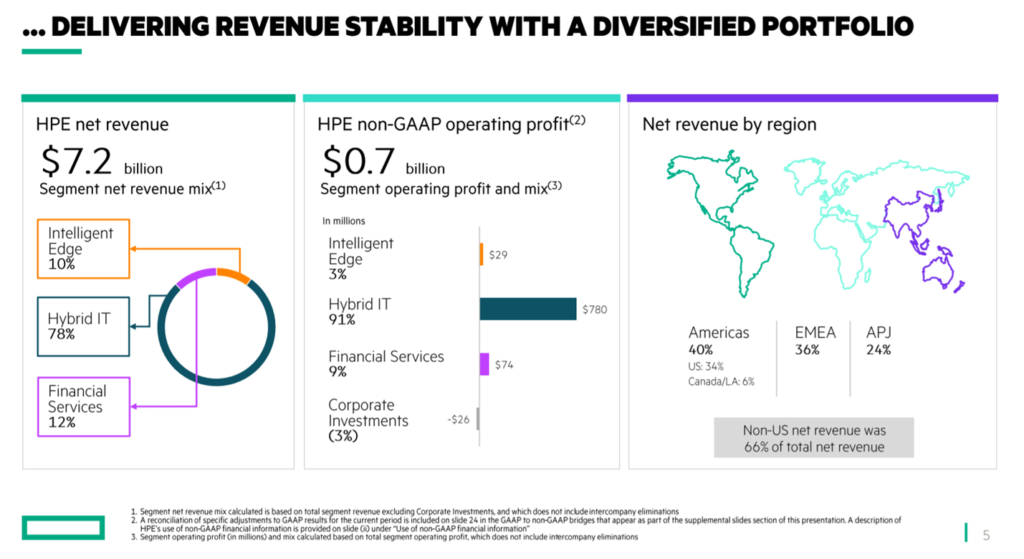

It is at this time of year that the IT community gets to hear all about the financial success of the vendor of most interest to the NonStop community – HPE. As November came to a close, HPE released its financial results for Q4, 2019, and provided us with an update for the whole of its financial year 2019 together with early guidance into what we can expect to see from HPE in 2020. The company is fully engaged in its own transformation from low value to high value sales, tracking away from high volume and towards deals where software and services play a bigger role in HPE’s business overall.

According to the HPE press release accompanying the Q4, 2019, results:

“We had a very successful fiscal year, marked by strong and consistent performance,” said Antonio Neri, president and CEO of HPE. “Through our disciplined execution, we improved profitability across the company and significantly exceeded our original non-GAAP earnings and cash flow outlook, while sharpening our focus, transforming our culture and delivering differentiated innovation to our customers as they accelerate their digital transformations. I am confident in our ability to drive sustainable, profitable growth as we continue to shift our portfolio to higher-value, software-defined solutions and execute our pivot to offering everything as a service by 2022,” Neri continued. “Our strategy to deliver an edge-to-cloud platform-as-a-service is unmatched in the industry.”

No surprises here really even as the top line did disappoint some analysts. As reported by Dan Anderson in a post to PULSE 2.0:

“Although HPE reported its fiscal fourth quarter with a profit of $480 million compared to a loss of $757 million in the same quarter a year ago. And revenue fell by about 9% to $7.22 billion from $7.95 billion a year ago. But Neri said that for the full fiscal year 2020, revenue in constant currency will grow.”

Surprisingly, this was a quarter where HPE made a one-time arbitration award payment of $668 million to DXC, which certainly didn’t help the company. On the other hand, it was a quarter too where deals were closed even as new acquisitions were made – and this is all part of previously announced plans by HPE to begin acquiring technology it believes will help further complete HPE’s product portfolio as it pursues its stated objective of providing its product offerings on the basis of XaaS – everything-as-a-service. It is being seen that when it comes to NonStop, the opportunity to run virtualized, as a software offering together with the progress being made to support NS-as-a-Service (NSaaS) and NonStop SQL-as-a-Service (DBaaS), the NonStop products are making their move to be closer to the center of HPE’s overall strategy with respect to Hybrid IT supporting both traditional and cloud.

Taking a closer look at FY 2019 overall, it’s clearly evident that HPE is shifting its product mix towards the higher value offerings associated with core and the edge. It will be important for all NonStop community members to watch how big a contribution NonStop will make to Hybrid IT and to the Intelligent Edge – a necessity when it comes to the future success of NonStop. Having said that, 2020 will only see baby-steps being taken in this regard, that is, apart from its ongoing push to migrate current NonStop users to NonStop X systems which will remain its primary focus for 2020. In other words, the bulk of NonStop revenues will come from NonStop X migrations with virtualized NonStop either at the core or the edge generating only a minimal amount to either Hybrid IT or the Intelligent Edge.

When it came to closing observations about where HPE is headed, it was Anderson who noted quotes by HPE’s Neri:

“We had record EPS growth, which was up 20%. We had record free cash flow, which is up 58%. And we grew on all the key strategic indicators of focus… strong double digits. And the one that I’m particularly pleased about is the momentum we have in the ‘as-a-service’ model, which in Q4 grew 72%. So that gives me the confidence, based on the portfolio and the innovation we brought to the market and the demand we see from customers, to basically drive that growth in a profitable way based on the shift we have made this year,” said Neri. “So that’s why I’m confident about the future, about 2020 and beyond.”

Yes, it’s been all about repositioning, acquiring, and marketing – a shift of focus by HPE – to better meet the needs of today’s enterprise and, by all accounts (including statements provided by NonStop senior management at recent events), NonStop continues to maintain a prominent role within Mission Critical Systems and with that, the NonStop community should be pleased. HPE is leaving the low value (high volume) market quickly and in turn, putting pressure on competitors to rethink their own strategies and for this, there can be no doubting how highly HPE values the contributions that NonStop is making to the overall performance of the company.

Only too happy to take your questions and observations – email me at:

Richard@pyalla-technologies.com

All opinions and observations expressed here

are those of Pyalla Technologies, LLC,

and unless otherwise expressly identified,

are not provided by HPE employees.