2021. What an interesting year. With the world turned upside down by a pandemic that seemingly had its sights set on...

Payment Processors: Are you ready to perform on Black Friday?

Insider Technologies

2018 has been a mixed year for the payment processing industry. Despite significant growth, major mergers, and the introduction of new players, the headlines have been filled with outages that have left consumers raging. Visa looked to have stolen the show in June with a Europe wide outage, but were quickly outdone by Mastercard in July. But these behemoths were by no means alone. Fintech’s Starling Bank and Patreon also got hit hard. And so has customer confidence.

Having the ability to forecast where and when networks are under strain enables payment processors to flag network pressures to their merchants. DR plans can be invoked with little interruption to the consumer. SLA’s continue to be met, with no financial penalty between processor and merchant.

RTLX is the cost-effective, real-time management framework for Monitoring, Tracking, Alerting and Querying the transaction flow across your payments platforms. RTLX simultaneously monitors the health of the underlying infrastructure for components such as subsystems, networks, databases, processes, events.

Monitor your entire payments environment

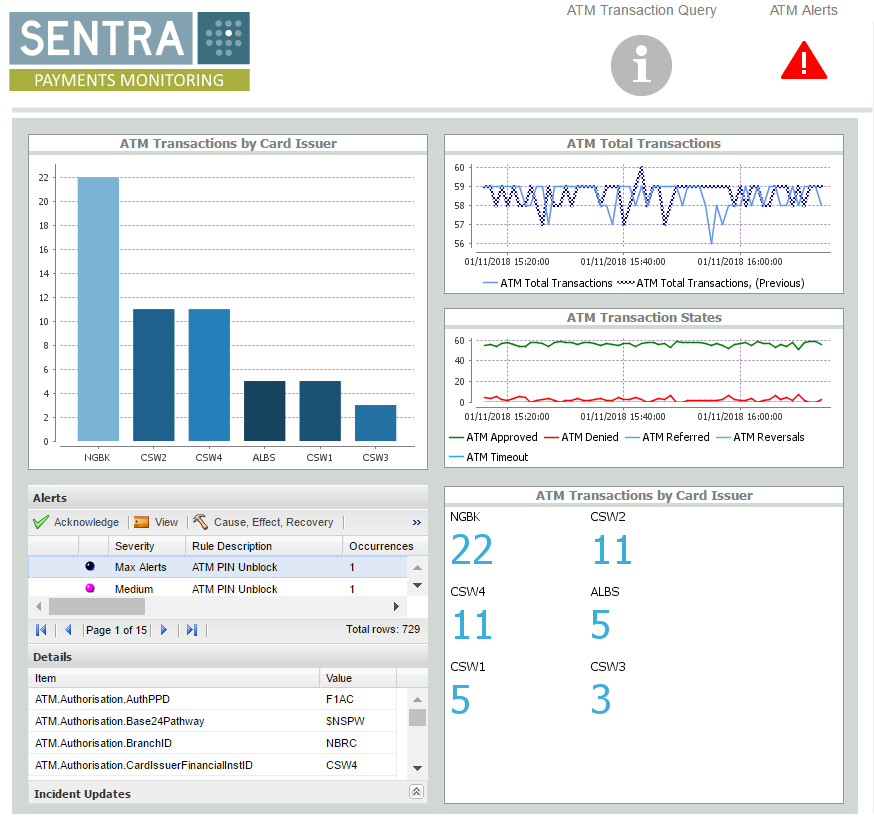

Real-time dashboards, together with exception alerting, escalation and RTLX’s unique query engine, provide an all-encompassing solution for the business to help identify and understand what is occurring within their payments environment.

RTLX is scalable and flexible to meet all needs of the business, catering from low, to large, high-volume transactional systems.

RTLX dashboards provide analytical and graphical results identified by issuer, acquirer, merchant (retailer), transaction types, card types, interchange responses times, queues, XPNET components and if required, user specific transaction values (tokens).

The powerful query engine provided with RTLX, enables users (with appropriate RTLX security access) to perform fast querying of ATM and POS card transactional data. Card data such as PAN and other sensitive data can be masked, complying with PCI DSS directives.

It takes seconds to query and retrieve the data; especially useful if a customer has made an enquiry concerning a transaction. No more back-office headaches to chase an enquiry – all transactional data, all tokens, including bespoke tokens are available at a touch of a button.

Architecture

The transaction log files for ATM and POS, e.g. TLF and PTLF, reside on the NonStop, or as in case of other payment platforms, such as *NIX and IBM systems.

RTLX extraction clients run on these systems (with minimum overheads) to relay in real-time, the data (in compressed form and via secure sockets), from the host system on to a Microsoft SQL server. From here, RTLX then provides the user with visuals, querying, rules and alerts.

Terabytes of data is being used by one of our Middle East customer to store 10+ years of BASE24 data, purely for transaction querying purposes. No longer do they need to load a tape and run Enforms.

RTLX server components reside on the Microsoft server with an associated SQL database. Various processes run to read and store the data being relayed from the host systems. Dashboards, charts, query engines are then available via a browser interface to provide real-time metrics and alerts, e.g. TPS, with drill-downs to display root causes of any problems.

Views are fully customisable. For example, ATM and POS trends, alerts, querying are provided via a single interface:

Don’t hit the headlines for all the wrong reasons. Spot problems before your customers do with real-time comparative historical analysis of the current payment, ATM/POS transaction flow against this time yesterday, last week, last month or last year to detect irregular transaction patterns.

Find out how RTLX can make your payments environment work for you. We’ll be at TBC 2018, so please drop by and see us alongside our sister company, ETI-NET, at Booth 21 in the Partner Pavilion.